open end loan examples

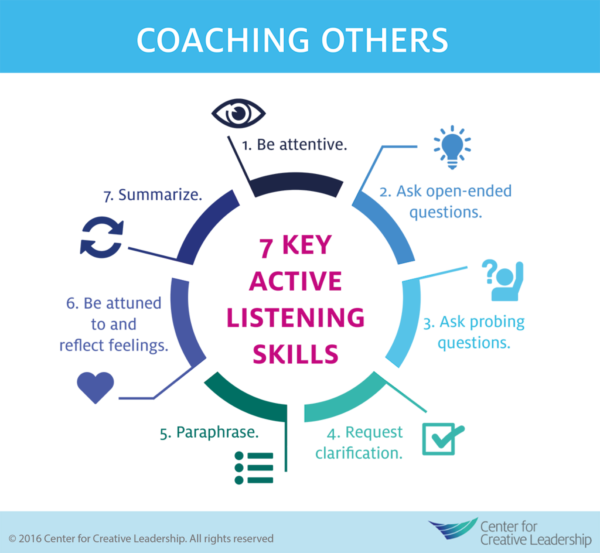

As well as build better relationships with clients in order to get to know them to build better rapport. Membership or Participation Fees.

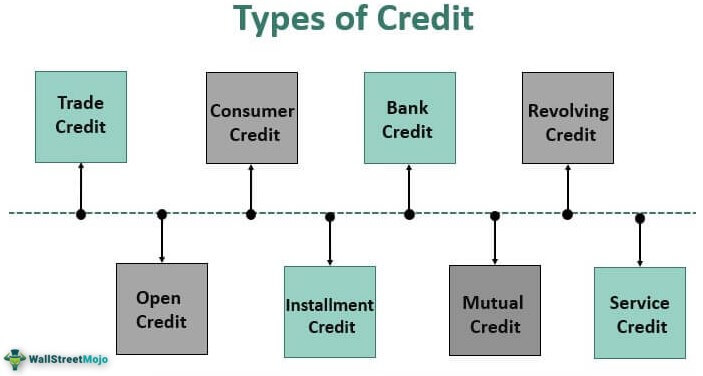

Types Of Credit List Of Top 8 Types Of Credit With Explanation

Open End Credit This is a type of credit loan paid on installments in which the total amount borrowed may.

. The loan has a term of 30 years with a fixed interest rate of 575. A closed-ended question is narrow and typically elicits a yes or. Definition and Examples of an Open-End Mortgage.

With a closed-end loan you borrow a specific amount of money. With some forms of open-end credit theres no end date. If the borrower does negotiate a modification of the loan the borrower will be subject to penalties as determined by the lender.

With open-end loans borrowers can spend money up to a. They really are a way to evoke more elaboration on topics as well as can be great in sales or simply influence when you want someone to buy. Any periodic rate that may be applied expressed as an annual percentage rate using that term or the abbreviation APR.

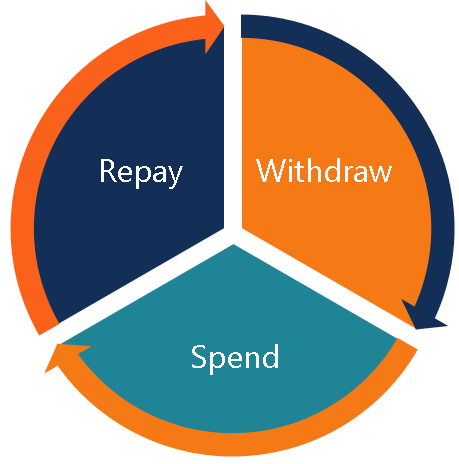

With closed end credit when you originally apply for a loan with the lender the terms never change. Banking Credit An open-ended loan is an extension of credit where money can be borrowed when you need it and paid back on an ongoing basis such as a credit card. Lets give an example of an open-end loan.

The difference between the two is that for an open-end mortgage the funds are available for a specific amount of time while open-end loans are revolving credits that can be reused. Department store service stationbank-issued credit cards and many others. Summary An open credit is a financial arrangement between a lender and a borrower that allows the latter to access credit repeatedly up to a specific maximum limit.

Closed end credit is different because it doesnt allow you to continue using the same credit over and over. An open-ended loan such as a credit card account or line of credit does not have a definite term or end date. For example assume a borrower obtains a 200000 open-end mortgage to purchase a home.

One of the benefits of an open ended line of credit is that the credit limit can be increased if the card is managed responsibly. Using a credit card issued by a store a bank card such as VISA or MasterCard or overdraft protection are examples of. Closed-end loan is a legal term applying to loans that cannot be modified by the borrower.

You take 10000 on an open-end loan. Examples of open-ended credit include the following. If the plan provides for a variable rate that fact must be disclosed.

You use 8000 of it repay 5000 of it in the next couple of months then your balance will show 7000this is money you can use again and then the wheel keeps turning. Examples of an Open-End Loan. With open-end or revolving credit loans are made on a continuous basis as you purchase items and you are billed periodically to make at least partial payment.

As you will get familiar with in the myriad of examples of open ended questions below. Like a traditional mortgage loan it gives the borrower enough cash to purchase a home. Specifically the borrower cannot change the number or amount of installments the maturity date and the credit terms.

By comparison loans for a predetermined amount such as auto loans are considered to be closed-end loans. This is how an open-end mortgage is compared to an open-end loan. A common type of open-end loan is a line of credit.

As you repay what youve borrowed you can draw from the credit line again and again. Credit Cards such as Visa Discover American Express and Sears. Home equity lines of credit HELOCs.

The cards allow you to charge up to a certain limit. View Test Prep - Open End Credit examples from MATH 140 at Colorado Technical University. Common examples of open-end credit are credit cards and lines of credit.

Closed-end loans are very different from the open-ended credit lines provided by credit card companies. To better understand open-end credit it helps to know what closed-end credit means. Bank overdrafts for checking accounts.

Why are open-ended questions helpful. Travel and entertainment cards TE cards Open-end loans can be categorized as either secured or unsecured. Triggered Terms 102616 b.

On an open ended line of credit you only pay interest if a balance is kept at the end of the statement period. Open-end loans offer you the chance to borrow as much or as little money as you want up to a certain amount and then pay back some or all of the funds monthly. Personal lines of credit and credit cards.

Example of an Open-End Mortgage. An open-ended question is broad and provokes a unique answer. Common examples of open end credit include credit cards or home equity lines of credit.

Understanding the terms of closed-end loans is critical. Depending on the product you use you might be able to access the funds via check card or electronic transfer. A closed-end loan offers a fixed sum of money to a borrower that must be paid back entirely in the timeline established by the lender.

Open-end loans can also take the form of credit cards or home equity lines of credit. In the consumer market home equity loans are an example of an open-end credit which allows homeowners to access funds based on the level of equity in the homes. A credit card is a kind of open-ended loan since the money is lent with no fixed end date.

An open-end mortgage is a unique type of home loan in that the borrower has the opportunity to use the funds from the loan as needed even after they purchase the property. In this article we explain the importance of open-ended questions in surveys and provide 30 open-ended question examples with strategies to help you connect with your customers. All Credit cards including.

Another open-end loan definition would be to say that its a revolving line of credit because the credit keeps.

25 Powerful Open Ended Questions To Boost Sales Business 2 Community

25 Powerful Open Ended Questions To Boost Sales Business 2 Community

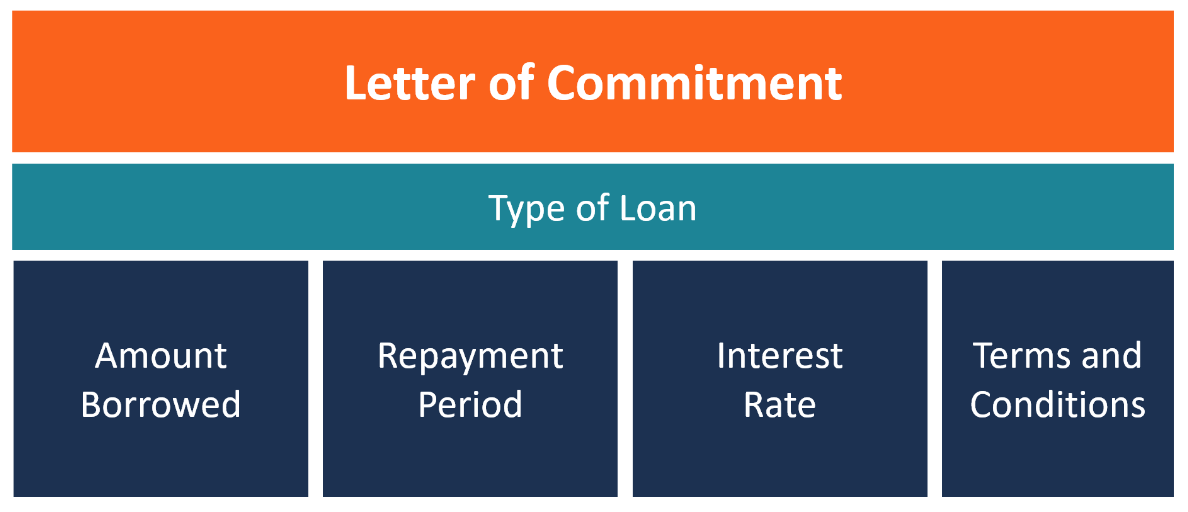

Letter Of Commitment Overview Example And Contents

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types Examples

/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types Examples

Chapter Open Ended Credit An Agreement To Lend The Borrower An Amount Up To A Stated Limit And To Allow Borrowing Up To That Limit Again Whenever Ppt Download

Lesson 16 2 Types Sources Of Credit Ppt Download

What Are Open Ended Close Ended Questions Definition Examples Writing Explained

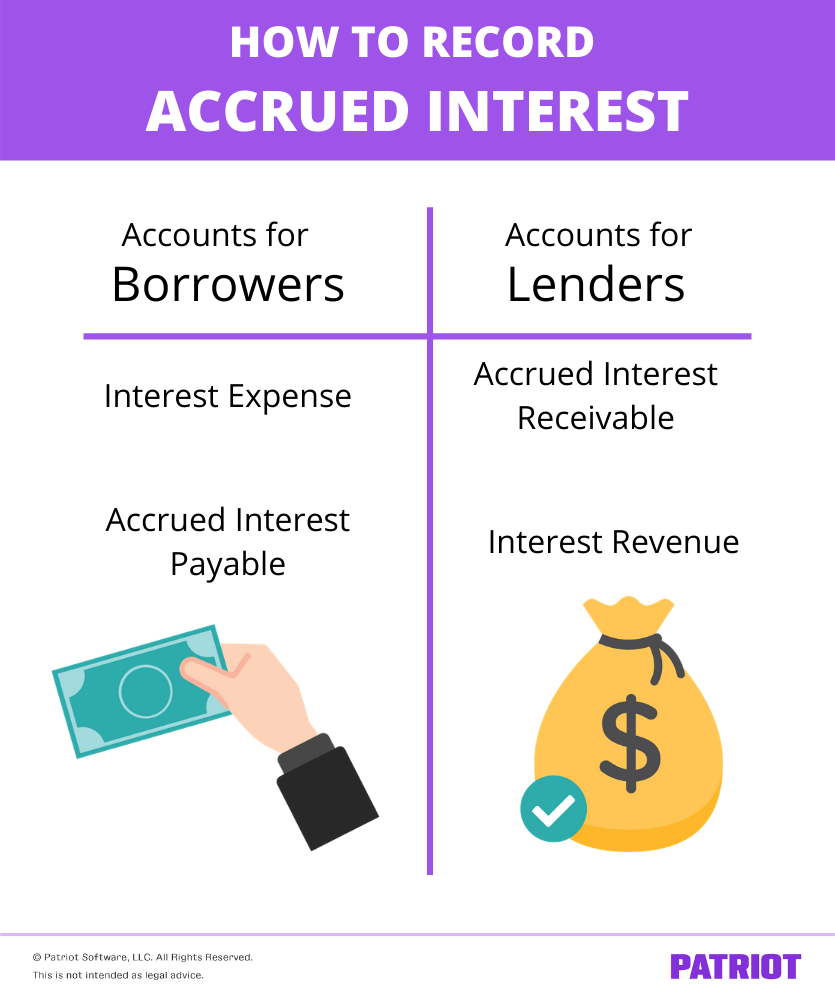

How To Record Accrued Interest Calculations Examples

Types Of Credit Definitions Examples Questions

What Is Open End Credit Experian

Truth In Lending Act Tila Consumer Rights Protections

25 Powerful Open Ended Questions To Boost Sales Business 2 Community

Essential Standard 5 00 Objective Ppt Download

25 Powerful Open Ended Questions To Boost Sales Business 2 Community

/GettyImages-923217650-70de1e010cdd4448b137a93421018b33.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Amortized_Loan_Oct_2020-01-3a606fa9285943098248ac92e8d03b40.jpg)